Aussie Rallies on Hawkish RBA Warning

-1707212483.png)

RBA Says Hikes Still Possible

The Australian Dollar is trading with a spring in its step across the European morning on Tuesday. Overnight, the RBA held rates unchanged, as expected. However, the tone of the meeting was a little more hawkish than most were expecting, catching the market somewhat off-guard. Traders have sharply scaled back their RBA tightening expectations over recent months, with most looking to gauge the likely timing of the bank’s first projected rate cut. However, the RBA was seen warning this month that further tightening could not be ruled out, noting that inflation was still too high.

Inflation Still too High

RBA governor Bullock acknowledged the pain being caused to “heavily indebted mortgage holders” but warned that the bank must “stay the course” on inflation. Indeed, in its latest inflation forecasts released overnight, the bank projects that inflation will only hit the midpoint of its 2%-3% target band in 2026.

RBA Vs ECB – Trading Divergence

With the RBA retaining a hawkish skew, AUD has risen across the FX space on Tuesday morning. Looking forward, the better opportunities to capitalise on AUD strength will come against currencies where the respective bank is subject to dovish market expectations. Traders are currently pegging the ECB to cut rates by April. If this pricing starts to come forward, this could create room for a fresh move higher in EURAUD near-term.

Technical Views

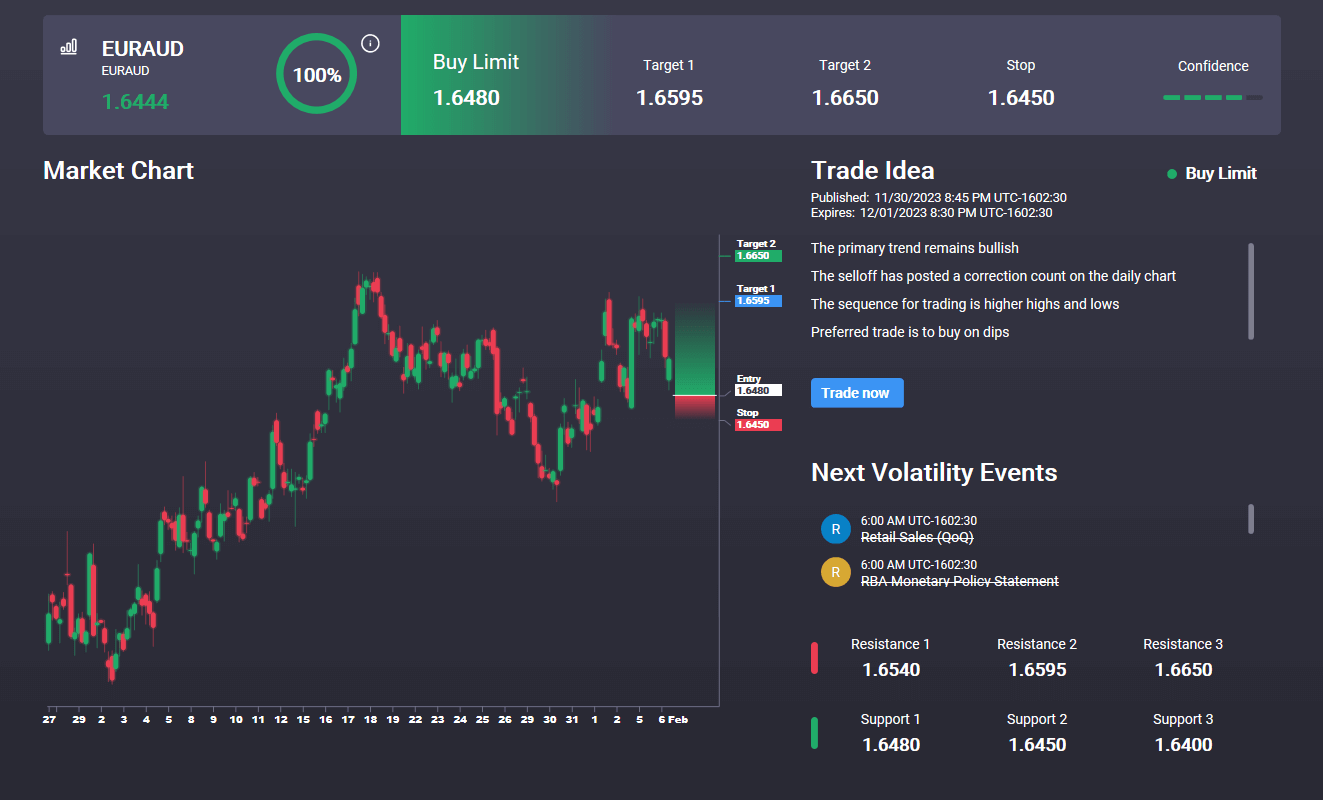

EURAUD

Following the rally off the 1.6249 level lows, the market has stalled for now into a test of the bear channel highs. Price is holding above the 1.6461 level currently, keeping focus on a potential channel break towards 1.6829. However, if we slip back below this level, focus shifts back towards a continuation of the bear trend and a fresh test of 1.6249. Notably, we have an active buy signal in the Signal Centre set at 1.6480 suggesting a preference to fade any move lower.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.