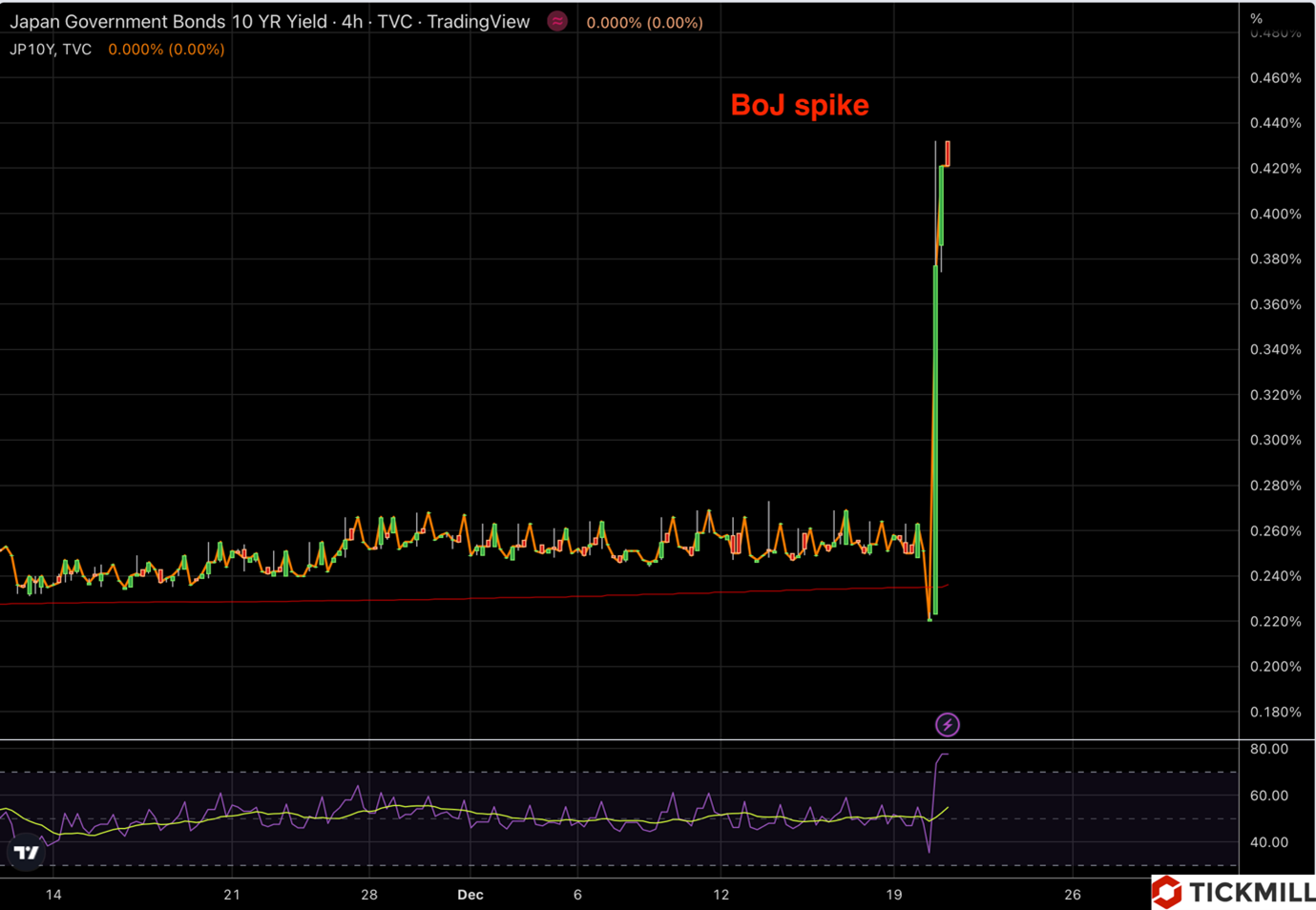

BoJ shocks markets with decision to loosen control over JGB yields

The Bank of Japan announced an unexpected change to its bond yield targeting policy and will now allow 10-year JGB yields to rise to 0.50%. Although Central Bank Governor Kuroda has warned unequivocally that this is not a rate hike, curbing speculation about a further BOJ normalization in 2023 will not be easy. USD/JPY may break through 130.00 on expectations that the Central Bank will finally start to drift away from its ultra-soft policy.

The Central Bank of Japan shook the markets today by announcing a surprise change in its yield curve control (YCC) policy. The target range for the 10-year JGB will be widened to +/- 0.50% from the previous 0.25%, indicating the BoJ attempt to retreat from the role of key buyer on JGB market.

The immediate impact on the yen was significant, with USD/JPY falling around 3.0% and currently trading around 133.00, 10-year JGB jumped to 0.42%:

The BOJ's role as an underdog among global central banks in the tightening race was a key driver of the yen's weakness in 2022, and markets are now evaluating whether today's announcement is actually the first step towards a broader normalization policy process in Japan that will radically change the outlook for the yen in 2023.

There is also a risk that speculation of even higher JGB rates in 2023 could spill over into global bonds and equities (as happened today). Gov. Haruhiko Kuroda's press conference focused on countering such speculation: He warned the markets not to interpret this as a rate hike and said he didn't see any further widening of the yield range necessary. However, markets may need more confidence on this, especially with Kuroda due to be replaced in April 2023.

USD/JPY risks are skewed further down and a move towards support at 130 cannot be ruled out – also given a generally weak dollar:

For now, the negative reaction of global stock markets is limiting the rise of pro-cyclical currencies and driving demand for the dollar, but broader dollar weakness is possible in the near future.

In the US, today the focus will be on housing data, with new home builds expected to continue declining in November as high mortgage rates continue to put pressure on the real estate sector.

The EUR/USD pair remained on the sidelines of the market reaction after the decision of the Bank of Japan, holding just above 1.0600. It is likely that the downward pressure on the dollar due to the hawkish policy of the Bank of Japan was fully offset by the worsening risk attitude, which negatively affects the pro-cyclical rate of the euro.

The eurozone calendar includes data on consumer confidence, which is expected to improve slightly in December, as well as speeches by ECB representatives Peter Casimir and Madis Muller.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.