REAL TIME NEWS

Loading...

Fed Rate-CheckUSDJPY remains weak today, gapping lower at the open, on the back of heavy selling on Friday in response to the Fed rate-check activity. News started coming through around the London close on Friday that the Fed was asking banks in New York about thei...

Fed Rate-CheckUSDJPY remains weak today, gapping lower at the open, on the back of heavy selling on Friday in response to the Fed rate-check activity.

SP500 LDN TRADING UPDATE 26/1/26***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE******WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***WEEKLY BULL BEAR ZONE 6880/70WEEKLY RANGE RES 7065 SUP 6928FEB OPEX STRADDLE 6726/7154MAR ...

SP500 LDN TRADING UPDATE 26/1/26***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE******WEEKLY ACTION AREA VIDEO TO F

Daily Market Outlook, January 26, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…U.S. stocks wrapped up a turbulent week with the S&P 500 marking its first back-to-back weekly decline since June, despite rebounding from e...

Daily Market Outlook, January 26, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…U.S. stocks wrapped up a turb

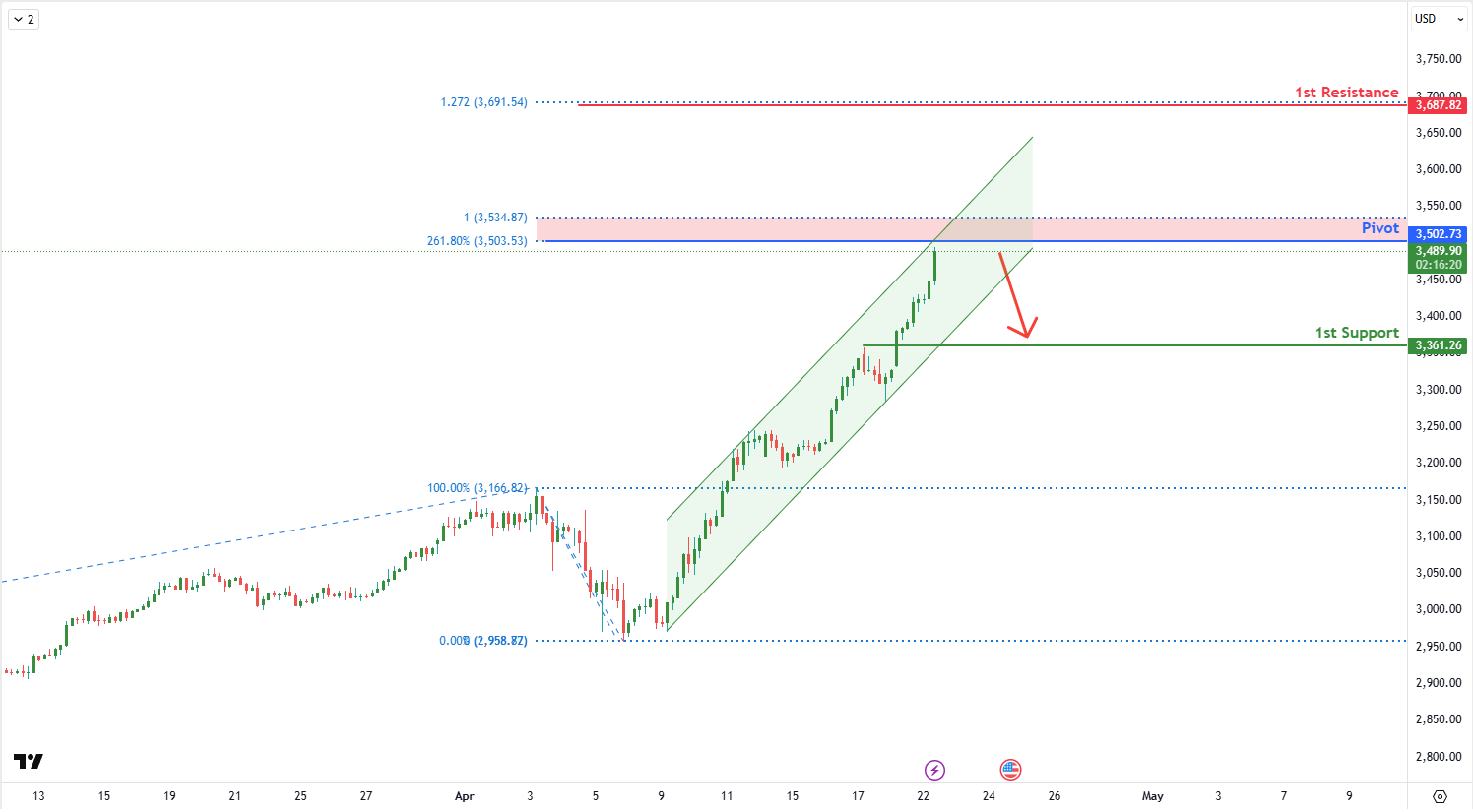

Gold Hits New Record HighsGold prices remain on watch this week with the futures market continuing to soar into fresh record highs. Price is now above the $5k level for the first time and shows no signs of slowing down as a firmly weaker USD and ongoing geopolitica...

Gold Hits New Record HighsGold prices remain on watch this week with the futures market continuing to soar into fresh record highs. Price is now above

VWAP Swing Strategy Weekly Review & Weekly Setups 25/1/25In this update, we review last week's setups and strategy performance, as well as identify the weekly opportunity set for the week ahead. To review this week's video, click here!...

VWAP Swing Strategy Weekly Review & Weekly Setups 25/1/25In this update, we review last week's setups and strategy performance, as well as id

VWAP Swing Strategy Trading Update 23/1/26In this video, we review last night's VWAP Swing Strategy scanner alerts, setups, and trades. For access to the strategy and scanner, email [email protected] for access details.https://www.tradingvi...

VWAP Swing Strategy Trading Update 23/1/26In this video, we review last night's VWAP Swing Strategy scanner alerts, setups, and trades. For acces

USD: Better US data produced “interesting” USD price action, but it reinforces her medium-term weaker USD view because growth upgrades and decent data still aren’t translating into sustained USD support.- USD structural theme: The investment/hedging narrative is bu...

USD: Better US data produced “interesting” USD price action, but it reinforces her medium-term weaker USD view because growth upgrades and decent data

The FX options market had a turbulent week, with the unexpected Trump-Greenland saga causing early spikes in implied volatility. Markets were shaken, and demand for options surged on Tuesday. However, as Trump walked back his comments during Davos, volatility eased...

The FX options market had a turbulent week, with the unexpected Trump-Greenland saga causing early spikes in implied volatility. Markets were shaken,

Dollar Heading LowerThe US Dollar is on course to end the week lower with the DXY down around 1.255, as of writing, following a reversal from last week’s highs. The move lower comes amidst a volatile macro backdrop this week. The opening theme for the week was Trum...

Dollar Heading LowerThe US Dollar is on course to end the week lower with the DXY down around 1.255, as of writing, following a reversal from last wee

DXY Daily Trade Setup 23/1/26In this update we review the recent price action in the dollar index and identify the next high-probability trading opportunities and price objectives to target. To review today's analysis, click here!...

DXY Daily Trade Setup 23/1/26In this update we review the recent price action in the dollar index and identify the next high-probability trading oppor

.png)

.jpeg)