Dollar Remains Under Pressure, Senate Run-off Elections in Focus

Markets stabilized on Wednesday after yesterday's sell-off in the US market, during which broad stock indexes pulled back by 1.5%. European and US stock index futures are marginally higher today, raising the likelihood that yesterday's sell-off was an event limited to one trading day.

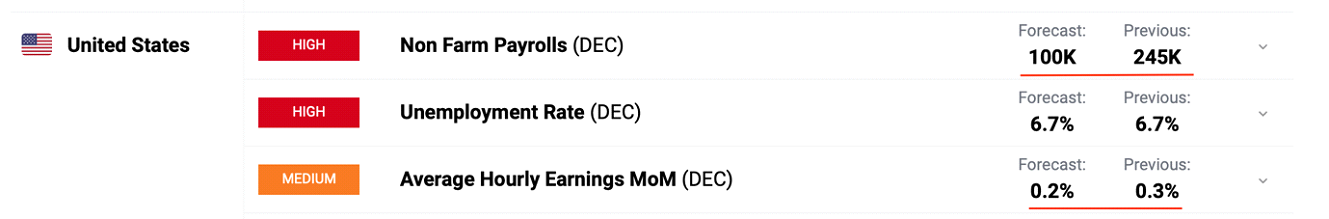

Covid-19 as a short-term risk fades into the background as the number of vaccines grows and vaccinations gain momentum. This week, the focus is on US labor market data, which will be released on Friday. According to consensus forecast, labor market is expected to post 100K gain in jobs in December, against 245K in November. That is, the labor market growth will continue to slow down. Wage growth is also expected to slow to 0.2%:

The outcome of the runoff elections in the swing state of Georgia is of great importance to market expectations. They determine who will fill the last two vacant seats in the Senate. To maintain a majority, Republicans must win at least one seat. If both seats are taken by the Democrats, despite an equal distribution of seats (50 for the Republicans and 50 for the Democrats), in fact, control over the Senate will pass into the hands of the Democrats, since the Democrat's Vice President Kamala Harris will have the decisive vote.

Polls now show that the Democratic candidates are in the lead by a small margin, but given the average bias in forecasts, the chances are roughly even. If Democrats gain control of the Senate, then in the medium term it will mean increased regulation, new taxes on the rich and corporations, increased income redistribution in the United States, but in the short term it will increase the chances of a larger stimulus package that will have a positive effect on stocks and negative for the dollar. Therefore, the dollar is now experiencing great difficulties to attract bulls.

Growth of EURUSD remains largely on a pause, while the weakening of the dollar paves the way for modest upside. As the outcome of the second round of elections remains uncertain, EURUSD growth will also be moderate. However, in the medium term, if the Fed continue to develop new concept of inflation targeting in the way of great tolerance of inflation upside, interest rates in the US will remain under pressure and fixed income assets in the US will become less attractive compared to foreign ones, what will increase pressure on US dollar.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.