Gold & US Debt Talks

Bullish Bias for Gold

Gold prices are holding around the middle of the 1973.51 – 2069.41 range following the correction lower from 2069.41 highs. Prices have corrected lower recently amidst an uptick in USD attached to unexpected strength in US consumer inflation expectations and some Fed pushback against rate cut expectations. USD has also been firmer recently amidst increasing uncertainty around the ongoing US debt ceiling negotiations.

US Debt Talks in Focus

Today, the next round of US debt ceiling talks as well as US retail sales will be the key factors affecting gold prices. Retail sales should see a fairly benign impact on markets unless we see any significant surprise in the data. However, the bigger impact is likely to be seen from the US debt talks. If no progress is made today, safe haven inflows are likely to favour a stronger USD which should exert some downward pressure on gold prices near-term. However, if any signs of progress are seen, gold prices have room to move higher as USD weakens into the middle of the week.

Technical Views

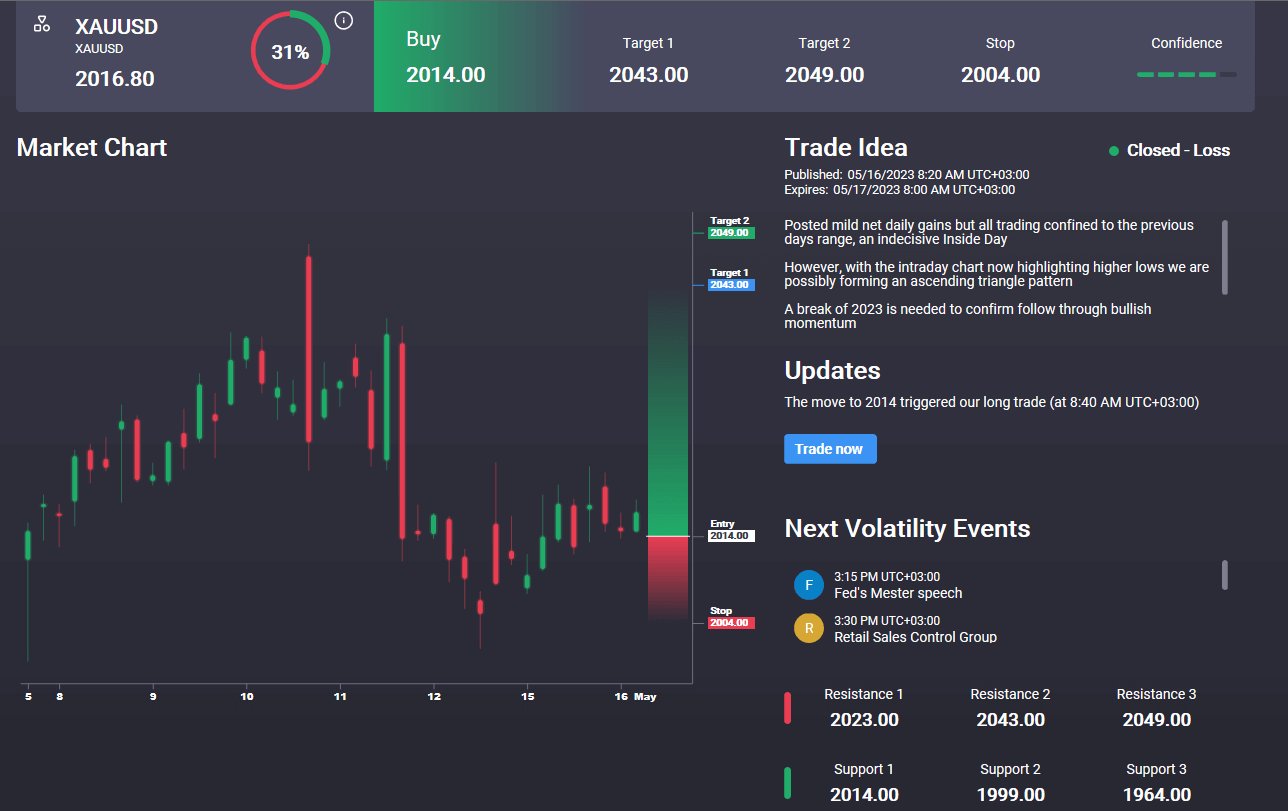

XAUUSD

For now, gold prices continue to hold mid channel, underpinned by support at the 1973.51. Given the broader bull trend, the focus is on a continuation higher and a break above the 2069.41 level next. With this in mind, any correction lower towards the range support and channel lows should find decent demand. The Signal Centre also has an active bullish signal on gold today with a buy order at 2014 targeting 2043.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.