NY Fed REPO Data Confirms the Fed had to Ease more to Solve Liquidity Crisis

Three days ago, the Fed delivered emergency rate cut by 50 basis points, but subsequent movement of the dollar, risk and safe heaven assets showed that the market wants more. Futures on US Treasury bonds also speak about this - the chances of reducing the rate by another 50 basis points on the March meeting are now 63%, although a day ago the market generally ruled out such an outcome.

Going beyond the valid but too broad argument of coronavirus-related pessimism which drives expectations of the dovish Fed, what else could make market players begin to expect even lower interest rates in just a couple of days? Is there any concrete data to make an assumption? In my opinion, there is, and it is connected with the “sore point” of the Fed’s ability to control market interest rates - REPO market.

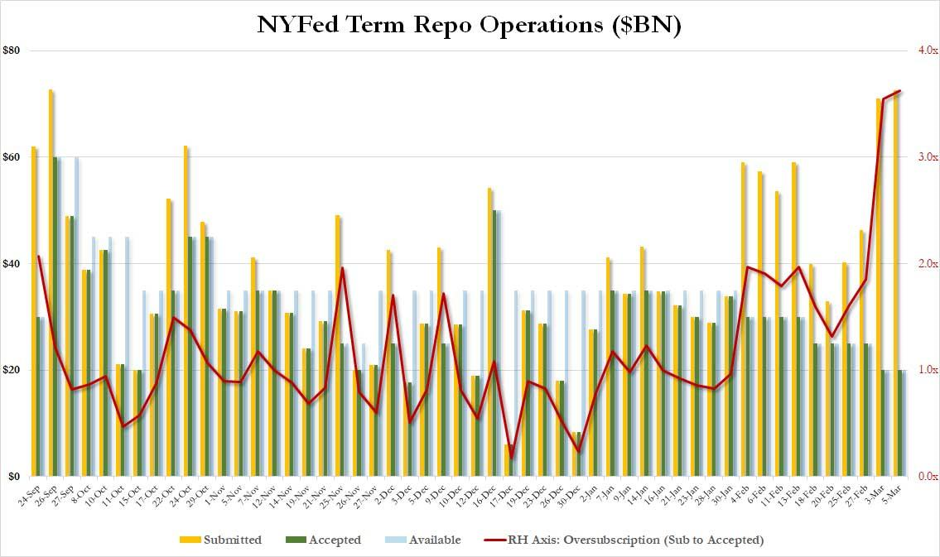

It is reasonable to think that the sharp decrease in borrowing costs by 50 basis points had to ease liquidity strains in the repo market and this should be reflected in the subsequent NY Fed data on repo operations. Recall that since September last year, the Federal Reserve Bank of New York has been offering liquidity in the form of overnight and term repos (1- and 14-days maturity) with the following data available:

The entire period of Repo program was characterized by the fact that the demand for 14-day “loans” constantly exceeded the supply and the market has been completely absorbing the supply of one-day liquidity. On March 3, the volume of liquidity provided amounted to a significant $100 billion, while dealers' demand for the first time since the crisis of October exceeded this value and amounted to $108 billion, which was a record. It is interesting that on the same day the Fed lowered the rate.

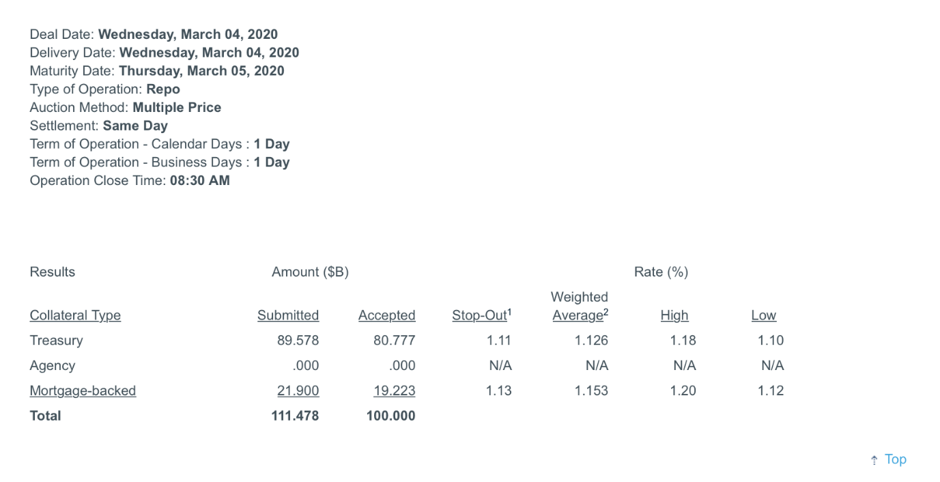

Most interestingly, the next day, the demand absorbed another $100 billion of overnight liquidity, while market dealers’ submitted value to rose to $111.48 billion. On March 5, applications for 14-day repo operations amounted to 72.55 billion, which is 3.6 times more than the offered 20 billion dollars:

In other words, already on the fourth of March, a day after Fed funds rate was reduced by 50 basis points, it was clear that it wasn’t enough. The liquidity crisis was not only not solved, but it continued to escalate, which began to form expectations of a new rate cut at the March meeting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.