Oil prices plunge on hints OPEC may raise output

European stock markets are down, STOXX 50 lost 0.6% amid reports of increased covid measures and new lockdowns in China, which increased market risk aversion. The yuan weakened again, with USDCNY rate increased from 7.02 to 7.16 over the week. The Japanese yen loses ground as well: USDJPY was up more than 1% today rising to 142 level. Liquidity will be less than usual this week, as the US market will be closed on Thursday and Friday due to Thanksgiving, so one should expect more than usual range of market moves.

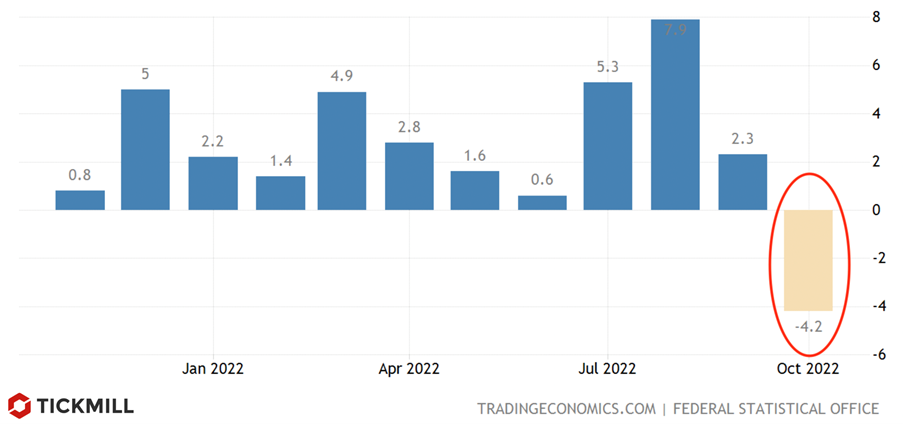

Among the positive updates, we can note the release of the PPI in Germany for October, which indicated a decrease in pipeline for the inflation pressure. On a monthly basis, producer prices decreased by 4.2% (forecast was +0.9%):

Producer inflation is the leading indicator of consumer inflation for locally produced goods, as producers typically pass on the increasing or decreasing costs to consumers with a lag. The decline in producer prices suggests that firms may lower final prices, which will favorably affect EU consumer price dynamics in the coming months.

Oil quotes fell almost 5% on Monday after a brief period of consolidation following reports that Saudi Arabia and other members of OPEC are considering output hikes by 500,000 b/d. Last week, the drop was of almost 10%:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.