The FTSE Finish Line: June 24- 2025

The FTSE Finish Line: June 24- 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London shares rose on Tuesday due to widespread gains following the implementation of a ceasefire between Israel and Iran, which concluded a 12-day conflict that had briefly increased oil prices and negatively affected investor confidence. Travel and leisure stocks experienced significant gains, driven by a rise in airline shares as oil prices hit a two-week low. The owner of British Airways, IAG, and EasyJet saw their stocks surge by over 5%, while midcap companies Wizz Air and Jet2 reported gains of 3.1% and 3.2%, respectively. Cruise operator Carnival led the mid-cap index with a 5.6% increase. Hotel operators Intercontinental Hotels and Whitbread each saw an approximate 2% rise. Nevertheless, the truce that U.S. President Donald Trump announced just hours earlier appeared tenuous, with the Israeli defence minister claiming new strikes had been ordered in retaliation for Iran’s alleged ceasefire breach, a claim Tehran rejected. Crude prices dropped following the ceasefire news, affecting major energy firms BP and Shell, which fell by 4.2% and 2.6%, respectively. Additionally, precious metals miners decreased by 2.2% in response to a decline in gold prices, traditionally regarded as a safe-haven asset. Investors are expected to closely monitor comments from Bank of England Governor Andrew Bailey and Chief Economist Huw Pill for indications regarding potential interest rate reductions. BoE Governor Andrew Bailey stated on Tuesday that the labour market in Britain is beginning to weaken. "We are starting to observe a softening in the labour market ... wage increases remain significantly above the level aligned with the target. Nevertheless, ... they are beginning to decline," Bailey remarked to the Economic Affairs Committee of the House of Lords .Markets are anticipating a probable decrease in borrowing costs by approximately 50 basis points by the year's end. In other developments, Prime Minister Keir Starmer has committed to increasing defence and security expenditures to 5% of economic output by 2035, as part of a NATO members' agreement made in The Hague. The aerospace and defence index has seen a slight increase and has risen by 55.5% this year, positioning it as one of the best-performing sectors in the FTSE.

Single Stock Stories & Broker Updates:

Shares in the UK banking index increased by 2.5% following the implementation of the ceasefire between Israel and Iran. U.S. President Donald Trump announced late Monday that both nations have reached an agreement. Barclays and Standard Chartered were among the leading gainers in the banking index and the larger FTSE 100, with nearly 3% growth. Major contributors to the sub-index included HSBC, which rose by 2.5%, Lloyds with a 1.28% increase, and NatWest, which gained 1.29%. Year-to-date, the sub-index has seen a 19.1% rise.

The British travel and leisure index rose by 3.9% following Trump's announcement of a ceasefire between Israel and Iran. Airlines like International Consolidated Airlines, Wizz Air, and Easyjet up 7.4% to 6.3%. Cruise operator Carnival rises 5.7%. Playtech, Entain, SSP Group, and Hollywood Bowl up 1.9% to 1.4%. Hotel chains Intercontinental Hotels and Whitbread rise 3.7% and 2.3%. Index down ~4% YTD.

Shares of Saga rise 3.1% to 171.5p, the highest since March 2. The company is in final talks with NatWest to provide personal banking products, including insurance and money services. Full-year holiday bookings are ahead of last year, with booked revenue up 14%. Saga's performance for the first four months meets expectations, and the company is on track for the full year. Year-to-date, shares are up 42.3%.

UK oil and gas producers index falls 4.4% to 7,928.4p as oil prices hit two-week low after Israel agrees to a ceasefire proposal with Iran. Shell and BP down 3.7% and 5.1%, while Harbour Energy falls 10.8%, leading losses on FTSE mid-cap. "If ceasefire is followed, investors might expect return to normalcy in oil," says Priyanka Sachdeva, market analyst. Sub-index up 0.6% YTD.

Technical & Trade View

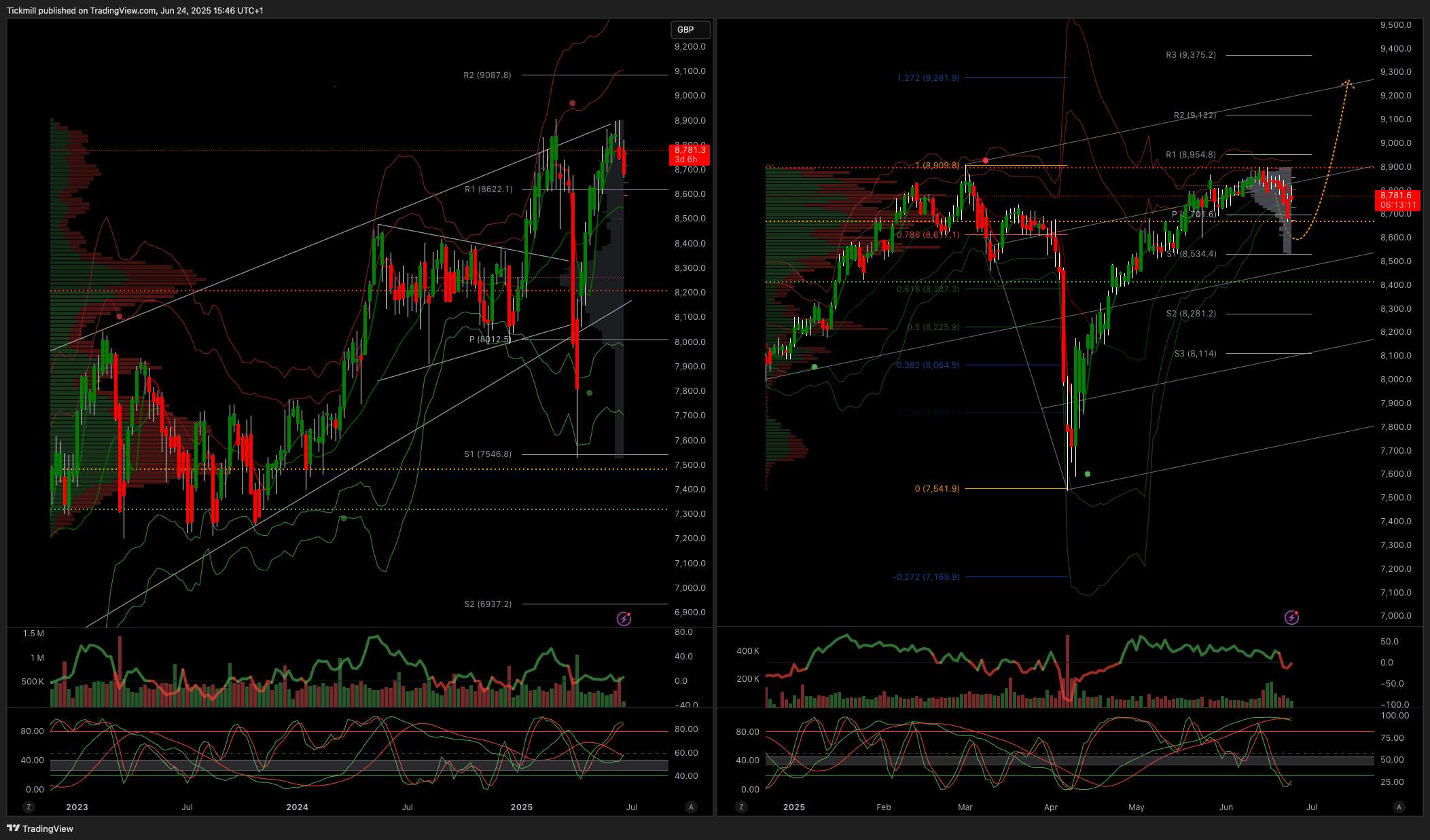

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!