USD Edges Higher Amid Fed Speeches; Euro Awaits ECB Rate Decision

The greenback began the week with a major offensive, even as parts of the US markets remain closed in observance of Columbus Day. Despite the bank holiday limiting trading activity, market participants are closely monitoring speeches from three Federal Reserve officials, particularly Governor Christopher Waller, known for his impactful market commentary.

Governor Waller's remarks are highly anticipated given their potential to influence monetary policy expectations. Recent US economic data have reinforced the market's conviction of an upcoming rate cut of 25 bp. The Producer Price Index for September showed a flat monthly reading of 0.0%, falling short of the anticipated 0.1% increase and down from August's 0.2% rise. Core PPI, excluding volatile food and energy prices, decelerated to 0.2% from 0.3% in the previous month.

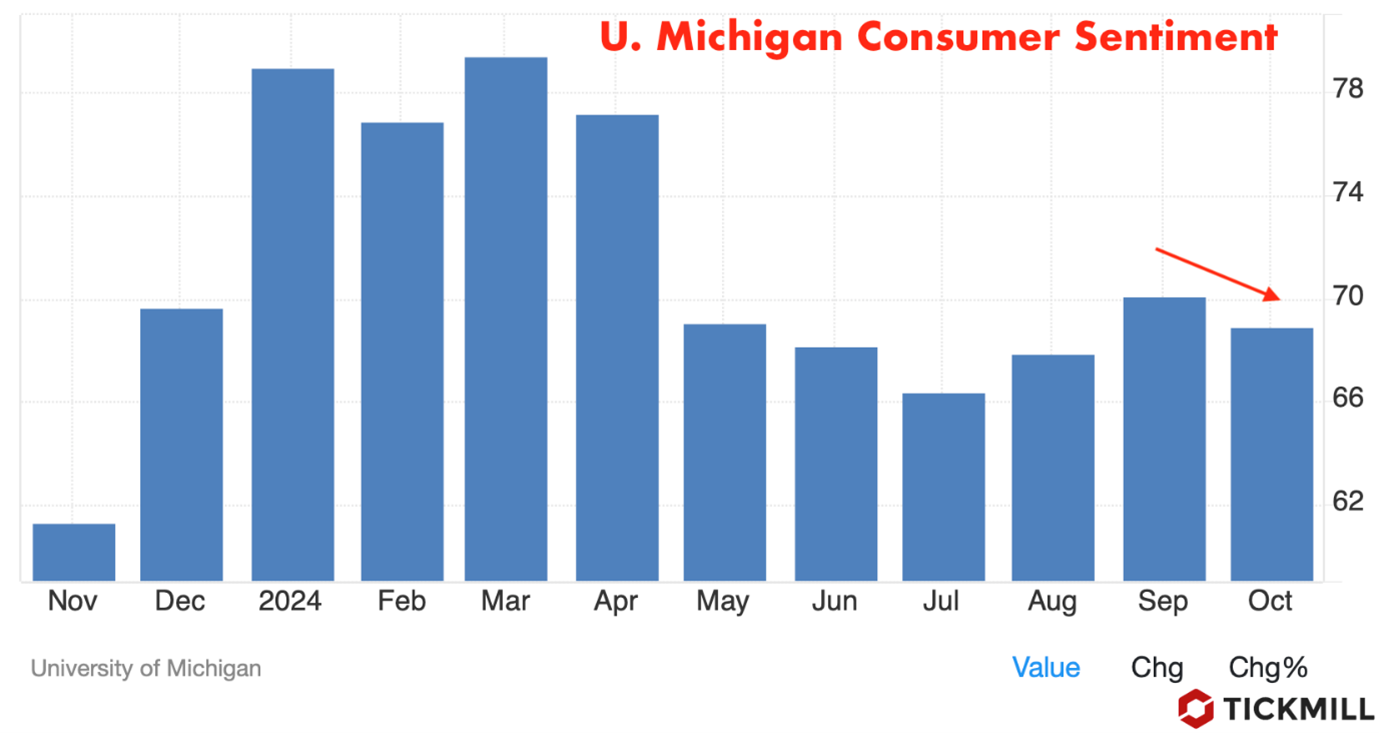

Moreover, the preliminary University of Michigan Consumer Sentiment Index for October declined, signaling potential headwinds for consumer spending—a key driver of US economic growth:

These data points have solidified expectations, with the interest rate futures pricing in an 88% probability of a 25 basis point rate cut at the FOMC meeting on November 7. The remaining 12% anticipate no change, while the likelihood of a larger 50 bps cut has been effectively ruled out.

The Euro is experiencing increased selling pressure as traders position themselves ahead of the ECB meeting scheduled for Thursday. The consensus among analysts now leans toward a 25 bps rate cut, which would mark the second consecutive reduction. Such a move is expected to weaken the Euro further due to decreased yield attractiveness, potentially leading to lower foreign capital inflows.

September's Eurozone inflation figures bolster the case for additional monetary easing. Headline inflation declined to 1.8%, dipping below the ECB's 2.0% target for the first time in over three years. Coupled with a slowdown in economic activity across the bloc, the data suggest that the ECB may need to accelerate its easing cycle to stave off deflationary pressures and stimulate growth.

The diverging monetary policy trajectories between the Federal Reserve and the ECB are likely to exert downward pressure on the EUR/USD currency pair. While the Fed appears poised to implement a measured rate cut, the ECB's potential for more aggressive easing could widen the interest rate differential. This scenario typically favors the currency with the higher yield—in this case, the USD:

The US Dollar Index (DXY), which measures the greenback against a basket of major currencies, broke above the 103.00 level. The absence of significant economic releases due to the holiday-shortened week means that upside is likely capped by the 103.50 level, where a bearish pullback is expected:

However, unexpected hawkish comments from Fed officials could lay a solid foundation for continuation of the upside trend with a potential target at the 104 level. Conversely, dovish signals may lead to a consolidation or slight retracement.

The additional stimulus package announced by the Chinese government has not generated significant market movements. This muted response may reflect investor skepticism regarding the effectiveness of fiscal measures in reversing the economic slowdown in China. Global markets appear to be in a holding pattern, awaiting concrete signs of improvement in Chinese economic data before adjusting risk exposures.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.