Who will win in the currency war? A brief analysis.

What’s the price of winning a currency war? This question is probably the key in determining the winner, as losses can be significant while it’s impossible to achieve an absolute victory over the enemy. A developed economy with a combination of high current account deficit, interest rates at safe distance from zero bound, low inflation, “dead” Phillips curve, and debt, denominated in the national currency is likely to be the winner. This is because it will pay the lowest price. Here’s why:

- A high current account deficit, financed by the sale of assets (debt) denominated in the national currency, will experience a positive effect from the devaluation of the currency, rather than from its strengthening. At least because of boosted exports and decreased imports.

- Expensive imports because of a currency devaluation will lead inflation to a dangerous level longer if initial inflation rate is low.

- The impact of policy easing on interest rates and exchange rate is higher the more room for rates to decline.

- With a dead Phillips curve inflation changes induced by currency devaluation will have less impact on unemployment.

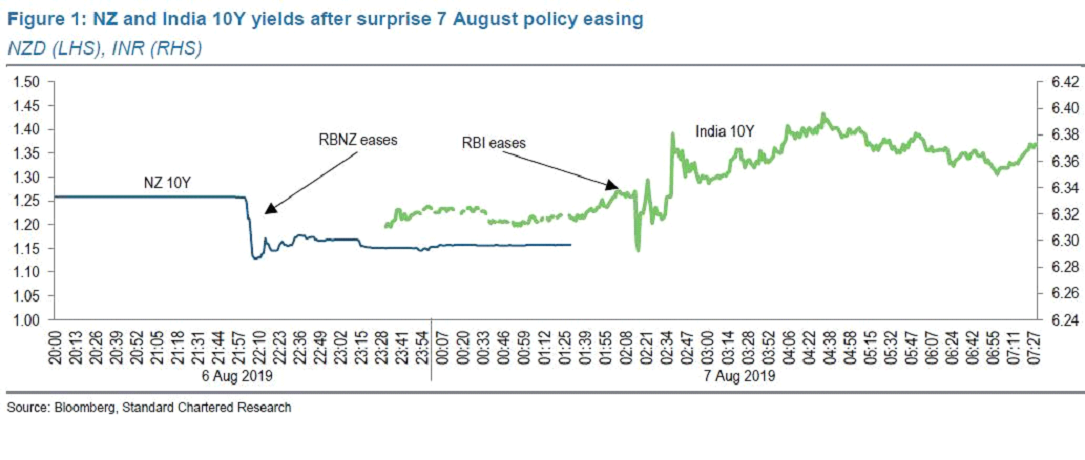

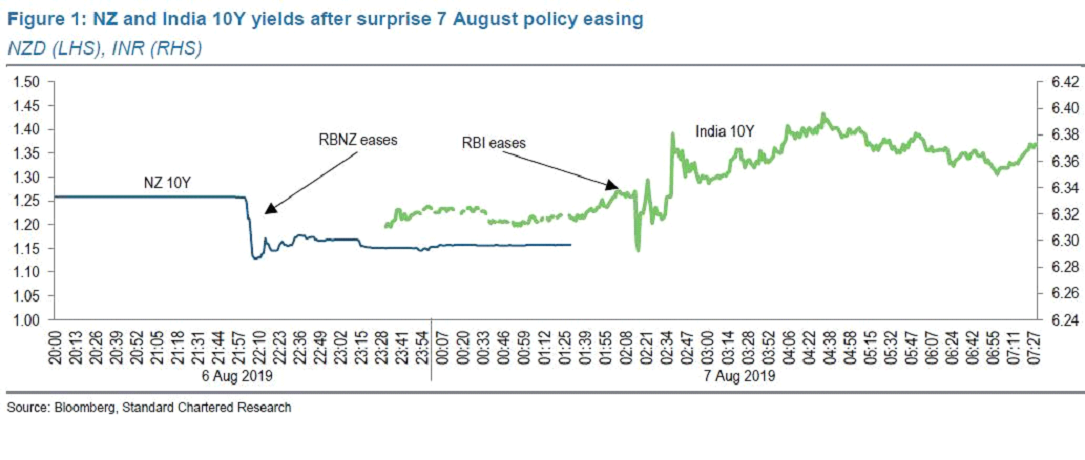

- The bond markets of developed countries respond positively to monetary stimulus which contains capital flight, even in the presence of an increased exchange rate risk. Emerging markets, on the other hand, are at risk of destabilizing at the far end of the yield curve when easing monetary policy or exchange rate, because of long-term credibility concerns. A fresh example is the recent rate cuts in New Zealand and India. The rate cuts took markets by surprise, and if in New Zealand the yield on 10-year bonds decreased after the decision (inflow), then in India it rose (outflow):

As a result, at the initial stages of a currency war, EM currencies may depreciate faster, however, due to greater ability of developed countries to extend devaluation, EM may eventually begin to strengthen.

As a result, at the initial stages of a currency war, EM currencies may depreciate faster, however, due to greater ability of developed countries to extend devaluation, EM may eventually begin to strengthen.

From the standpoint inflation, among the G20 countries, none of the countries has inflation above 2.25%, that is, many of them are approaching the target level from below, unlike EM countries. In China, India, Vietnam, Hong Kong, inflation significantly exceeds 2.25%. With a devaluation, the risk of accelerating inflation is higher in the latter. It’s like this because the higher the rate of inflation, the more is potential acceleration in absolute terms. We should also take into account next the fact that: the share of food and fuel in the consumer basket of developed countries is lower, therefore, accelerating inflation will bring less discomfort in terms of falling living standards. Whereas in the US the share of these goods takes an average of 11% and the weight in CPI is 20%, in Vietnam the share of food and beverages is 40% of CPI and their share in the consumer basket is also much higher.

The United States undoubtedly has the most favorable combination of factors described above among G10 countries. The low inflation rate, wide margin between current interest rates and zero bound, better position of the balance of payments suggests that the US will win the protracted currency war. However, it is obvious that the status of a safe heaven, reserve currency and liquidity can limit the weakening of the dollar in a currency war if heavy risk aversion develops.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.